Throughout our history, we have built, based on our values and principles, an operation with countless quality features, proving Ânima’s proposal to transform the Country through Education.

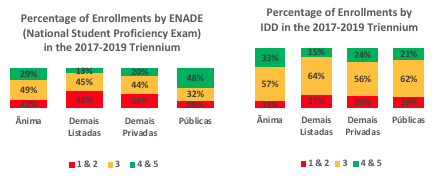

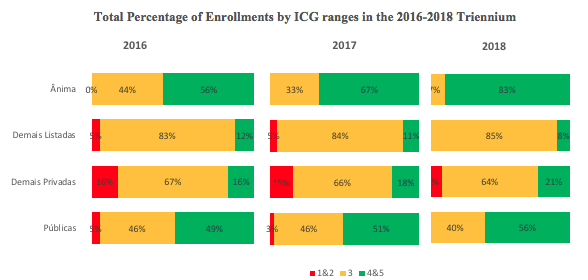

Best performance in Brazilian Higher-Education: In the last MEC/Inep Census, Ânima had the best results in the Brazilian higher education. Our institutions had 83% of grades 4 and 5 in the Courses General Rate [IGC - Indíce Geral de Cursos], the main quality indicator from the Ministry of Education. The performance is even better than that of public institutions (64%), as well as private institutions (21%) and listed institutions (8%).

High-quality education Through Ecossistema Ânima de Aprendizagem (E2A): We are the first group in the Country to create a competence-focused model. Ânima’s academic proceeding values development of the students’ autonomy, targeting an extensive formation of the professional, individual, and citizen, looking to make sure students have access to a quality academic education. Pursuant to Hoper’s studies, 47.7% of motives considered by students in the process of choosing a higher-education institution are related to quality¹ of the institutions, while only 22% are related to the institutions’ location. Through its own methodology, Ânima’s program provides a modular and interdisciplinary approach, allowing for the student to connect with different subjects of each course, adding value to their learning process. This goes beyond program standardization, based on anachronistic vision, as adopted by several learning institutions in Brazil, of simple content transmission. Recognizing that, with advent of technology, access to content is practically universal, the Company’s focus is on development of permanent capacities that allow higher autonomy and a more extensive performance of students when exercising their professions.

¹ It have been considered as motives related to quality the following items from Hoper’s Study: quality, market recognition, friends endorsement, tradition and brand recognition, and Enade results.

Distinctive business model: Allowing a privileged positioning so Ânima can reap the growth potential of the Brazilian education segment. We believe in promoting a high standard for academic quality that, with a strong corporate culture, leads to positive and sustainable results throughout the time. Besides, there is a growing demand (by MEC, by the labor market and also by students) for quality in the education segment in Brazil, placing us in a unique position compared to other private education institutions. Thus, Ânima believes that it has a competitive advantage over competitors in the private segment, as the company is ready to keep up with the higher education segment, capturing more value for shareholders.

Great tradition and reputation brand portfolio: Education brands in Brazil are mainly local/regional, with exceptions usually restricted to general mass or niche institutions, operating in one area or in a few areas of education. Una, UniBH, São Judas, Unisociesc, Ages, Unicuritiba, Faseh and UniFG are traditional brands, with more than one decade in their operating regions. Ânima seeks an independent and unique position for the brands, respecting the strategic positioning and the commitment to teaching quality, without loss from introducing modern and innovative elements, main characteristics of the Company. This skill to create own identities makes it possible, for example, to manage two teaching institutions in the same city (Una and UniBH), with similar price and portfolio positionings, in a synergistic way, attracting students with different profiles and expanding the market share of both institutions, simultaneously. Therefore, Ânima brand works as a significant amalgamation, mainly for the corporate world, strengthening the concept of network, absorbing and transferring credibility to educational institutions.

Institutions that are reference in other sectors: HSM, EBRADI, SingularityU Brazil, HSMu, Inspirali and Le Cordon Bleu are part of what we call ‘knowledge vertical’, as business units with brands renowned in the country for their expertise in certain knowledge, strengthening local operations by certifying local brands (co-branding) and developing new scalable services and products through the network. We believe that the reputation and position in the market have decisively contributed to the success of acquisitions the Company has made in recent years, as well as for the integration of the acquired institutions. This will also be key in the future growth strategy. As the education segment is very fragmented, with many strong regional brands, the strategy to preserve the acquired brands brings more benefits from the regional reputation of these brands and the recognition of the principles and values of Ânima’s business model, after integrated to the network.

Quality in Law, holding “OAB Recomenda” certificate: One of the main references of quality of a Law Course is the recommendation from the Brazilian Bar. Two higher education institutions from Ânima are among the few in the Country that have this feature: São Judas University [Universidade São Judas] and Curitiba University [UNICURITIBA]. These are triumphs that represent the translation of how the EBRADI model, another brand of the group, in partnership with our Academic Vice-Presidency (VPA), can leverage and empower our Law Courses.

Valorization of people: Ânima’s development is linked directly to people related to the group, since the success of a institution depends on the development of its own, authentic organizational culture, based on values and principles practiced on a daily basis. Thus, the development of employees and teachers is encouraged through specific initiatives for each audience. For nearly two decades, our foundations have been grounder on the values of transparency, respect, cooperation, commitment, recognition, and innovation. These values permeate all our actions, not only as a company but also - and especially - in our relations with our students, educator, partners, and everyone around us. That is why, among so many achievements, we figure among the best companies to work in Brazil, according to the Great Place to Work survey (GPTW/Época Magazine). This reflects the workplace we are building for our teachers and employees - people who are passionate about what they do, who trust in the power of education and who believe that together they can change the country. This mission is engraved in the DNA of Ânima and our institutions.

Strong significant-growth of profitability profile: Company’s operations hold great profitability and significant return over invested capital. Moreover, when acquiring an institution, it is pursed maximization of synergy and operational efficiency and, consequently, transforming these actions in an increase of profitability of its operations. The purpose of distinctive value and solid reputation of Ânima’s brands allow us to charge fees higher than market’s average, which translates into a EBITA per student also higher than the other open capital companies in educational sector, which focuses on standardized learning, making it possible to continue with consistent growth and performance of investments in quality.

Exploitation of opportunities for consolidation in the sector: Part of Ânima’s growth strategy is based on mergers and acquisitions of other learning institutions. We look for identifying assets capable of adding value and competively and that, at the same time, may make use of the Group’s curricular technology, centralized proceedings, and corporate structures. For that, we have a rigid selection proceeding for possible acquisitions. The analysis takes into consideration two great aspects: (i) appeal of the market and its competitive environment, assessed through qualitative and quantitative analysis that compare several social, demographic, and market aspects. and (ii) appeal of the institution, assessed with basis on criteria such as institutional strength, risks, and potentialities in relation to: (a) branding, (b) team/human capital, (c) management of potential synergies, (d) adherence to position, values, principles, and corporate culture of Ânima and (e) financial and operational performance. Group’s CSC, a tool designed to provide it with an administrative, financial, and academic integrated and more effective platform, capable of catalyzing the best practices of each one of Company’s institutions and the quality-standard offered by all its unities, allows the integration of other institutions and business unities to become faster and more efficient, making it possible the reduction of incremental costs and generating relevant scale improvements. Ânima believes that these factors allow it to integrate acquisitions in a fast, efficient, and profitable manner. Moreover, we also consider that the capitalization resulting from the Offering, besides liquidity, provided flexibility to the negotiation proceeding, opening new opportunities.